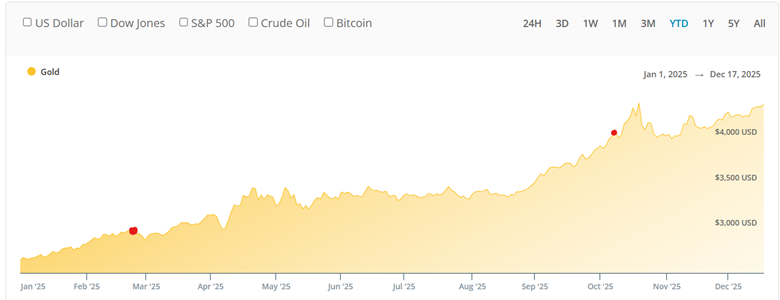

We’ve been on the $4k side of gold for months at this point. It feels like a new normal. It took decades to go from $1,000 to $3,000 – but just months to breach $4k…

Gold moved from $3k in March to $4k in October – faster than almost anyone predicted.

As I’ve written many times before, substantial corrections are normal during this kind of bull market. We already saw a pretty big correction after gold’s run to over $4,300 in late October. Gold fell back below $4,000 in the subsequent two weeks. That represented a ~10% move – but honestly, it would not surprise me to see a 20-40% correction at some point in the coming years.

Keep that in mind: big corrections in the metal’s price are normal during a bull market. Volatility in currency markets, laws, wars, and other market disruptions cause wild swings in dollar denominations over short periods of time. But the trend is intact.

Gold has since topped October’s highs, and the bull seems to be back in full swing.

But there’s something weird going on in gold stocks.

I’m not complaining… my gold stocks are doing great right now… but if you look at my open portfolios, you’ll see that with few exceptions, all 40+ companies I cover are well under my fair value price targets.

I’ve had to continually and regularly update my target prices – mostly because gold keeps moving higher.

In many cases, the value prospect is BETTER today at $4,300 gold than they were at $2,600 a year ago.

Think about this:

Even some of the best gold stocks are still being analyzed based on $3,000 gold. To the extent that junior mining stocks have analyst coverage, the whole industry is baking in much lower gold prices to their models. That’s sometimes due to financial models that use a trailing average of gold prices over 12-18 months.

But after a 60%+ move in gold prices over the past year, there’s a massive lag that undervalues gold stocks using such methodology.

This ultra-conservative modeling also reveals something important about the psychology of the gold market.

People are still reluctant to go “all-in” on the bull trend. They’re waiting for the shoe to drop. Many of the analysts and insiders remember the hot stove that burned them in 2011-2012 when the whole market cratered after a 20-year bull market in the metal.

The reluctance to peg gold stock valuations anything close to current metal prices proves we’re still early. Only when we see the opposite will we know we’re nearing the end. When analysts are projecting the highest possible priced gold for their gold stock models, then we’ll know it’s time to take profits.

Until then, we have years left to build positions and make intelligent investments in the sector.

Don’t be fooled by strength in the gold stock sector. The market is confused about the real value out there. For now…

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio